child tax credit october 2021 date

All tax year 2021 income up to the date of death must be reported and all credits and deductions to which the decedent is entitled may be claimed. Because of the American Rescue Plan signed by President Biden in March 2021 bona fide residents of Puerto Rico are eligible to receive the same expanded Child Tax Credit as residents of the 50 States or the District of Columbia3600 per qualifying child under age 6 and 3000 per qualifying child age 6 to 17.

Enter your information on Schedule 8812 Form.

. The credit increased from 2000 per. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. A childs age determines the amount.

To reconcile advance payments on your 2021 return. Under the American Rescue Plan the maximum child tax credit rose to 3000 from 2000 per child for children ages 6 and older and it rose to 3600 from 2000 for children ages 5 and younger. Get your advance payments total and number of qualifying children in your online account.

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. The fourth monthly payment of the enhanced Child Tax Credit landed in bank accounts Friday with anti-poverty researchers pointing to the ongoing cash. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

1052 AM PDT October 15 2021 The October installment of the advanced child tax credit payment is. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. This fourth batch of advance monthly payments totaling about 15 billion is reaching about 36 million families.

File a federal return to claim your child tax credit. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax. The next payment goes out on Oct.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The IRS will soon allow claimants to adjust their income and custodial.

Parents income matters too. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. You can beneit from the credit even if you.

It also lets recipients unenroll from advance payments in favor of a one-time credit when filing their 2021 taxes. Figure your 2021 Child Tax Credit. The deadline for the next payment was October 4.

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit.

The IRS has confirmed that theyll soon allow claimants to adjust their. Report the advance Child Tax Credit payments you and your spouse received in 2021. The Child Tax Credit is a fully refundable tax credit for families with qualifying children.

For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17. 15 by direct deposit and through the mail. I filed my 2021 tax return electronically but made a mistake.

This change removed the previous requirement that a resident. The IRS has confirmed that theyll soon allow claimants to adjust their. October 14 2021 726 AM MoneyWatch.

Pay dates for the rest of the child tax credit checks. We explain the key deadlines for child tax credit in October Credit. 1 day agoWith the 2021 child tax credit parents were able to receive the full amount -- up to 3600 -- if their child was born by the end of December.

Simple or complex always free. IR-2021-201 October 15 2021. The Biden Administration is seeking to renew the enhanced CTC through.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of October. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. The American Rescue Plan expanded the Child Tax Credit for 2021 to get more help to more families.

2021 Advance Child Tax Credit Payments start July 15 2021 Eligible families can receive advance payments of up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above. Payments begin July 15 and will be sent monthly through December 15 without any further action required.

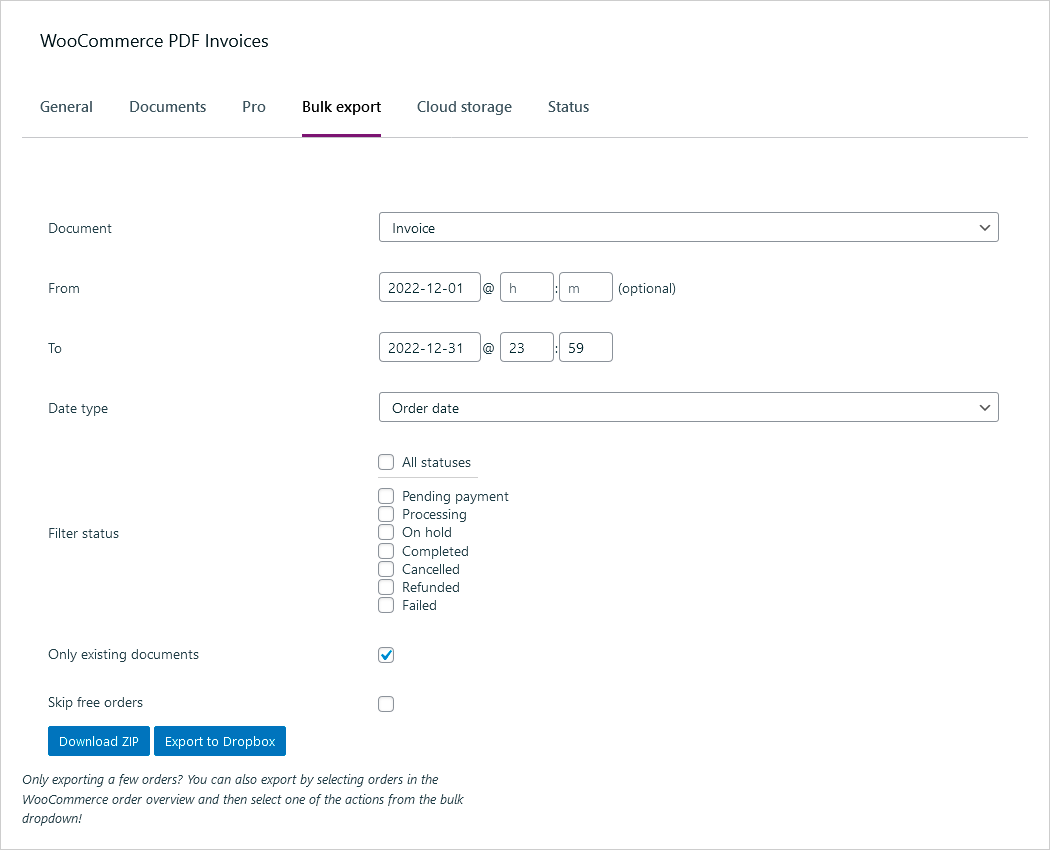

Woocommerce Order Delivery Date And Time Slot Seletion Plugin

Woocommerce Order Delivery Date And Time Slot Seletion Plugin

Usa Finance And Payments Live Updates Gas Stimulus Check Tax Deadline Child Tax Credit Tax Refunds As Usa

2021 Us Tax Deadlines Expat Us Tax

Woocommerce Pdf Credit Notes Proforma Invoices

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Gstr 1 Due Date October December 2020 Goods And Service Tax Goods And Services Udemy Coupon

Input Tax Credit Tax Credits Indirect Tax Tax Rules

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Child Tax Credit Will There Be Another Check In April 2022 Marca

Some Parents Won T Get Child Tax Credit Payments Unless They Sign Up By Oct 15 Here S Why Cnet

The Big Longs Of The Big Short Hero The Big Short Michael Burry Company Values

2022 Tax Deadlines And Extensions For Americans Abroad

Tds Due Dates October 2020 Dating Due Date Income Tax Return